US Stock Market Dips Days Before Trump's New Tariffs Take Effect

GET YOUR FREE WEALTH KIT NOW

FILL OUT THE FORM TO GET YOUR ULTIMATE WEALTH KIT

US Stock Market Dips Days Before Trump's New Tariffs Take Effect

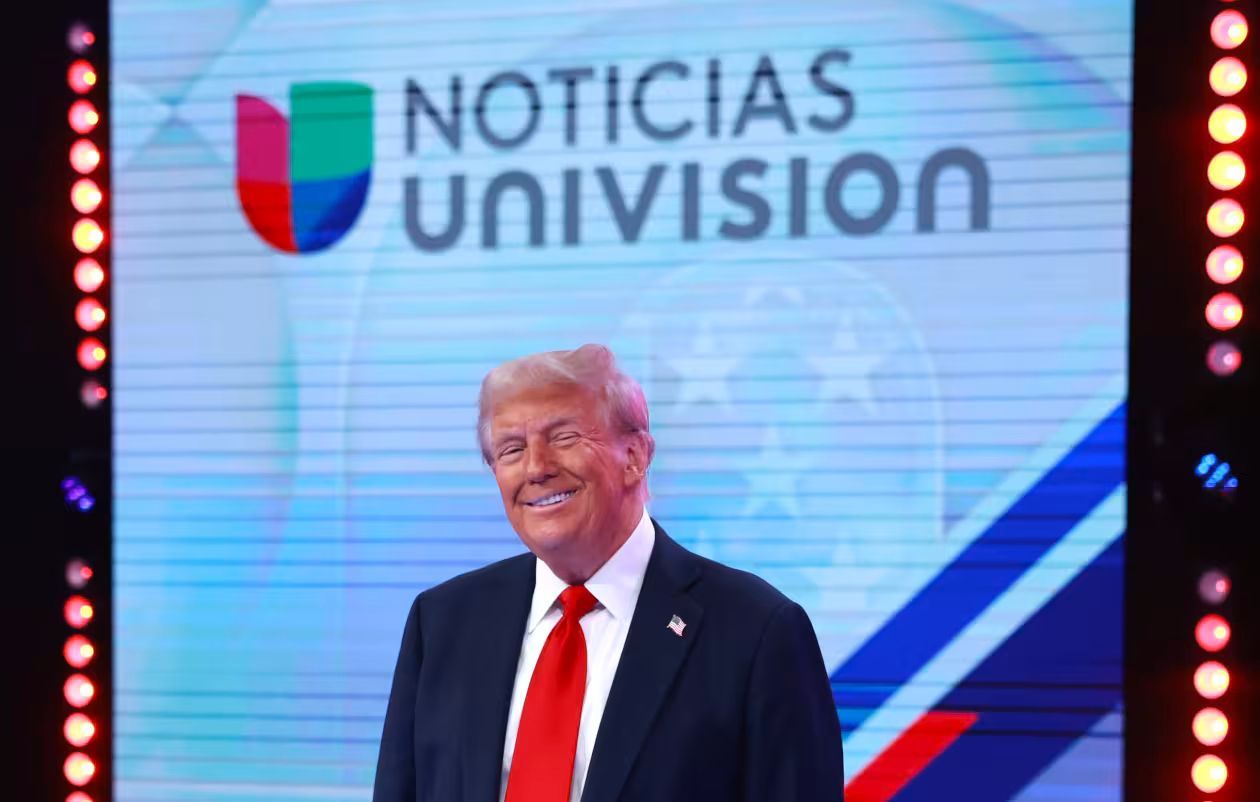

In a turbulent turn of events, US stock markets have once again fallen, with investors bracing for President Donald Trump's imminent announcement of a sweeping new slate of import taxes. Set to be unveiled this Wednesday, Trump has dubbed this new round of tariffs “America's Liberation Day,” signaling a fresh chapter in the nation's trade policy that could have far-reaching consequences for both the US and global economies.

This latest market dip follows growing anxiety among investors as they anticipate the impact of these new tariffs, not just on the US economy, but also on the global trade landscape. The timing of the announcement has only compounded investor uncertainty, as it comes just days before the new taxes are expected to take effect.

Global Markets React to US Tariff Threats

The ripple effect of these tariff concerns has been felt far beyond US borders. In Asia, Japan's Nikkei index experienced a sharp decline, dropping by more than 4% as traders reacted to the looming uncertainty of the new tariffs. Meanwhile, across the Atlantic, the UK’s FTSE 100 closed almost 1% lower, reflecting the widespread anxiety surrounding the US’s aggressive trade policies. The news has cast a shadow over international markets, prompting fears of a global slowdown as countries adjust to the potential fallout.

Trump's Tariff Plan: A Broad-Sided Approach

President Trump’s statement earlier this week further fueled concerns when he suggested that the new tariffs would target all countries, not just those with the most significant trade imbalances with the US. This announcement stands in contrast to the administration's previous focus on specific nations like China, Mexico, and the European Union, which had been the primary targets of US trade actions. By expanding the scope of his tariff policies, Trump is sending a clear message that no country will be exempt from the economic pressures he plans to impose.

Such a sweeping strategy raises alarms among global trade partners, who are now preparing for potential disruptions to established trade relationships. With economies already reeling from the ongoing trade war between the US and China, the possibility of more countries being drawn into the fray has only added to the tension.

The UK Prepares for Impact

The UK, a key US trading partner, has already voiced concerns about the potential impact of these new tariffs. Downing Street has stated that it “expects” to be affected by the US’s new trade measures and is not ruling out the possibility of retaliatory tariffs. This adds another layer of complexity to the already fraught relationship between the US and the UK, which has been navigating the challenges of Brexit while managing its own economic recovery.

The prospect of retaliatory tariffs from the UK and other countries could escalate the situation further, leading to a global tit-for-tat that could harm trade flows, increase costs for consumers, and dampen global growth prospects.

A Continuation of Existing Tariff Measures

The new tariffs are expected to be added on top of several other duties that the US has already imposed on a variety of goods. These include significant tariffs on aluminium, steel, and vehicles, as well as increased levies on all goods imported from China. These existing measures have already disrupted global supply chains and hurt industries that rely on international trade.

For US manufacturers, the increased costs of raw materials like steel and aluminium have put pressure on their bottom lines, while industries like the automotive sector have faced higher costs for imported vehicles and parts. Likewise, businesses across the world that rely on Chinese imports have struggled with the higher costs resulting from US tariffs.

As these new tariffs are rolled out, it’s likely that the disruptions and costs will continue to mount, potentially pushing global economies further toward recession.

Dharshini David’s Analysis: What’s Next?

Despite the looming uncertainty, it’s still unclear exactly what President Trump’s tariff plan will entail and how it will affect global markets. Analysts like Dharshini David have pointed out that, given the twists and backtracking that have characterized Trump’s trade policies thus far, it’s difficult to predict what the final details of his plan will look like. In the past, the President has shifted course on trade agreements and tariff plans, often leaving both markets and foreign governments scrambling to keep up with changes in direction.

The lack of clarity has only added to the anxiety among investors and businesses alike, as they wonder how the President’s final decision will impact everything from global trade flows to stock market stability. This unpredictability is one of the key reasons why markets have reacted so negatively, with investors seeking safety amid the volatility.

Global Uncertainty and the Road Ahead

As the situation continues to unfold, it’s clear that both the US and global economies are facing a period of uncertainty. Trump’s planned tariffs are just the latest development in an ongoing saga of shifting trade policies that have left markets on edge. With global supply chains already stressed and key economies dealing with the fallout from previous rounds of tariffs, the announcement of new trade barriers could tip the scales toward a global economic slowdown.

In the coming days, all eyes will be on President Trump as he unveils the details of his tariff plan. Will it be a game-changer, or will it be another round of tariffs that disappoints traders and businesses? Whatever the outcome, one thing is certain: the global economy and the stock markets are in for a bumpy ride in the months ahead. For now, investors will be watching closely, trying to gauge the full impact of the US’s latest tariff moves on the global economy and their portfolios.

As we wait for Wednesday’s announcement, the world’s financial markets remain on edge, poised for whatever Trump’s next move will bring. The only certainty at this point is the uncertainty itself.

GET YOUR FREE WEALTH KIT NOW

FILL OUT THE FORM TO GET YOUR ULTIMATE WEALTH KIT

MORE NEWS

ABOUT

THE FREEDOM REPORT

The Freedom Report is a news media agency located in Los Angeles, California.

We are a group of industry veterans with collective experience and news/media journaling experience of over 20 years. Our goal is to give you unfiltered and reliable news that you can look towards for a source of truth.

FREEDOM REPORT